A new Redfin report paints a troubling picture of housing affordability in America, particularly for Gen Z and millennial renters and homeowners. Seven in 10 renters in those generations say they struggle to make their regular housing payments. Even homeowners in the same age group are feeling the pressure, with 41 percent saying the same.

The study, based on a May 2025 survey of more than 4,000 U.S. adults, shows just how widespread the crunch has become. Younger generations were hit hardest, though baby boomers and Gen Xers are also affected. Over half of baby boomer renters and more than two-thirds of Gen X renters said they have a hard time making monthly payments.

To make ends meet, young renters are cutting back on eating out, with 40 percent saying they dine at restaurants less often. Nearly one-third are skipping vacations, 27 percent borrow money from family or friends, and 25 percent pick up extra shifts. Some of the most drastic measures include selling belongings, delaying medical treatments, and in more than one in five cases, skipping meals.

Millennials and Gen Zers who own their homes report similar adjustments. They are more likely than renters to cut luxuries like eating out and traveling, but fewer said they are skipping meals or putting off doctor visits to make mortgage payments. Older Americans also trim back on non-essentials. Roughly 45 percent of baby boomer and Gen X homeowners said they cut back on restaurants, and two in five reported taking no or fewer vacations.

The backdrop is a basic affordability problem. Home prices are up more than 40 percent since before the pandemic, mortgage rates have doubled, and rents have climbed more than 20 percent. Wages, on the other hand, have grown about 28 percent in the same period. Younger workers typically earn less because they are earlier in their careers. Many are also burdened with student loans and do not have equity from a previous home sale to help.

“Many Gen Zers and millennials are making real sacrifices, picking up side gigs, selling their possessions, even delaying doctor’s appointments just to pay for the basic need of housing,” said Daryl Fairweather, Redfin’s chief economist. She added that “a lot of the young people who can easily afford housing can do so because they have major financial support from their parents, with roughly one-quarter of the young Americans who recently bought a home using family money for their down payments.”

Fairweather warned that with home costs rising much faster than wages, “people without access to family money are much more likely to struggle to pay for housing, which could widen the gap between the haves and the have-nots in the future.”

There are a few encouraging signs, however. Mortgage rates recently dropped to a 10-month low. Buyers now have more purchasing power and sellers are more willing to negotiate. Affordability has even improved in 11 major metro areas, including parts of California and Florida.

Jim Fletcher, a Redfin Premier agent in Tampa, Florida, explained that “the local market is slow, with builders offering incentives to entice people to buy and individual sellers willing to negotiate because there’s so much supply on the market.” He suggested that for people early in their careers, “it’s a good time to start building equity. They can get homes for less than they could have a few years ago, especially if they’re open to condos or townhouses.”

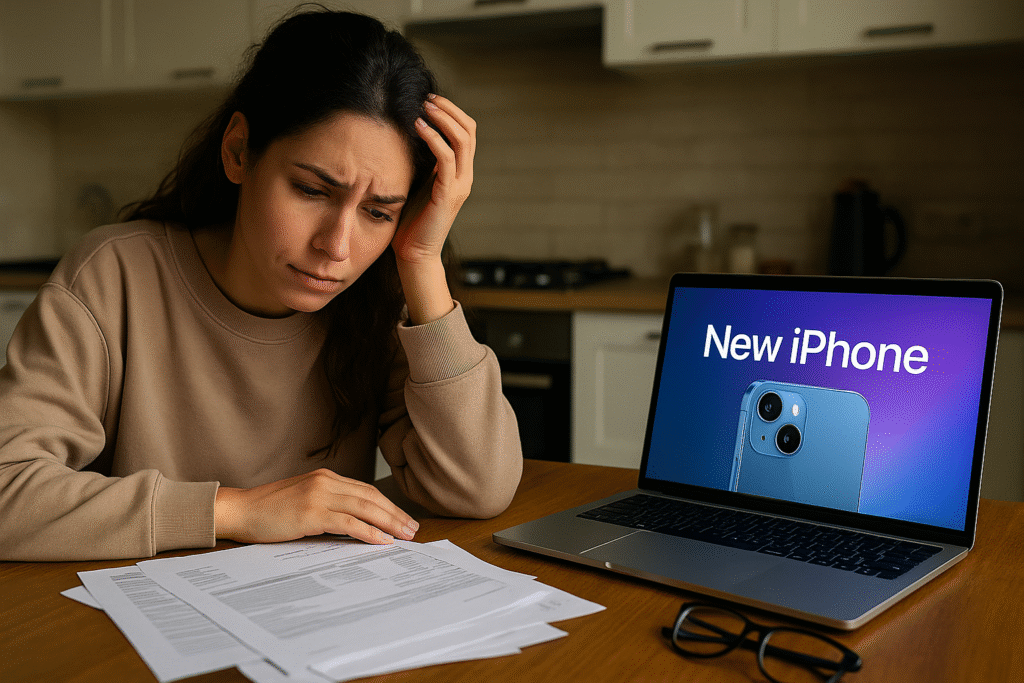

But the report also raises a larger question. If so many young people are skipping meals and delaying medical care just to afford rent, how are they still buying the latest smartphones, tablets, and laptops?

Look, folks, flagship devices now range from $800 to more than $2,000 nowadays. Even so-called budget laptops and tablets remain a serious expense. If housing continues to strain budgets, younger buyers may finally cut back on yearly gadget upgrades. That could ripple into the consumer tech industry, which depends heavily on these same demographics for steady sales.